Dragonfly Doji candles are unique in that they appear very similar to the Hammer candle. However, there is one key difference: the Dragonfly Doji’s body is located near the high and low of the session, while the Hammer’s body is located near the open and close. This formation can be used to spot reversals in a downtrend or to confirm continuation signals in an uptrend. In this blog post, we will discuss how these candles form and explore some trading strategies that you can use when trading with them!

Table of Contents

What are Dragonfly Doji Candles?

Dragonfly candlestick is unique in that it forms very similar to the Hammer candle. The difference is that the Dragonfly Doji’s body is located near the high and low of the session, while the Hammer’s body is located near the open and close. This formation can be used to spot reversals in a downtrend or confirm continuation signals in an uptrend. In this blog post, we will discuss how these candles form and explore some trading strategies that you can use when trading with them!

How do Dragonfly Doji Candles Form?

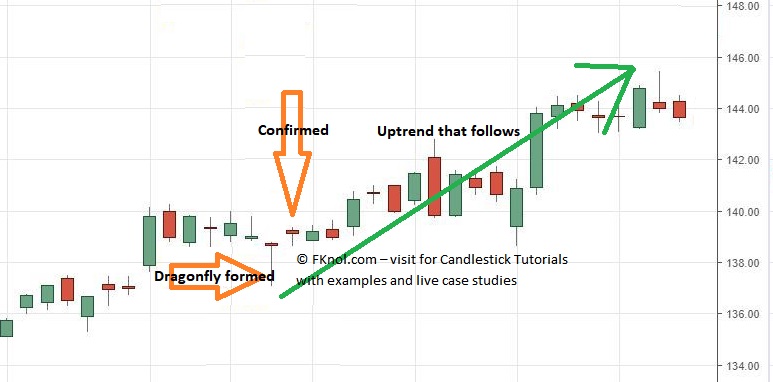

Dragonfly Doji candles typically form after a strong move in the market. They are most commonly seen in downtrends, where they can be used to spot reversals. The candle will open at the low of the day, rise to the high, and then close near the low again. This formation is also known as a “long-legged Doji”.

What Trading Strategies Can You Use with Dragonfly Doji candles?

There are a few different trading strategies that you can use when trading with Dragonfly candlestick. Here are a few of our favorites:

1. Use the Dragonfly Doji as a reversal signal in a downtrend

2. Use the Dragonfly Doji to confirm continuation signals in an uptrend

3. Trade breakouts of the Dragonfly Doji candle

4. Trade pullbacks to the Dragonfly Doji candle

5. Use the Dragonfly Doji as a confirmation signal for other indicators or chart patterns

Benefits of Trading with Dragonfly Doji Candles

There are a few benefits of trading with Dragonfly Doji candles. Here are a few of our favorites:

1. Easy to spot – The Dragonfly Doji candle is easy to spot on most charting platforms.

2. Reversal signal – The Dragonfly Doji can be used as a reversal signal in a downtrend.

3. Confirmation signal – The Dragonfly Doji can be used to confirm continuation signals in an uptrend.

4. Can be traded with other indicators or chart patterns – The Dragonfly Doji can be used in conjunction with other indicators or chart patterns to create powerful trading signals.

5. Profit potential – There is potential for profits when trading with the Dragonfly Doji candle.

How to Trade with Dragonfly Doji Candles

Now that you know about the Dragonfly Doji candle and the trading strategies that you can use with it, it’s time to learn how to trade with it! Here are a few steps that you can follow:

1. Choose a currency pair to trade – The first step is to choose a currency pair to trade. We recommend starting with a pair that you are familiar with.

2. Look at the chart – Next, take a look at the chart and identify where the Dragonfly Doji candle has formed.

3. Decide which trading strategy to use – Now that you know where the Dragonfly Doji candle has formed, you need to decide which trading strategy to use.

4. Enter a trade – Once you have decided on a trading strategy, enter a trade according to your plan.

5. Exit the trade – Finally, exit the trade according to your plan.

Dragonfly Doji candles can be powerful trading tools when used correctly. By understanding how they form and what trading strategies you can use with them, you can increase your chances of success when trading the markets!

Best Timing for Trading Dragonfly Doji Candles

Dragonfly Doji candles are unique because they can be used as both reversal and continuation signals. As with any other candle formation, the best timing for trading dragonfly Doji candles will depend on the context of the market. In general, they are most effective when spotted in downtrends after a strong move and can be used to confirm reversal signals.

Dragonfly Doji candles can also be used as continuation signals in uptrends. When used in combination with other indicators or chart patterns, they can be a powerful tool for traders. As with any other trading strategy, it is important to only trade dragonfly Doji candles when the market is in a valid trend and to use proper risk management techniques.