Working with data is fun. If it’s not true for everyone, at least there’s a space to agree on- the significance.

While having different natures and interpretations, there won’t be the same software or method one will implement every time. As a data analyst or trader, it’s not difficult to know or guess what’s different in Monte Carlo simulation stock trading systems comparing other techniques.

If you’re new to this, let’s know little by little.

Table of Contents

What is Monte Carlo simulation?

The history of Monte Carlo is quite interesting. First, the focus comes on the name. It’s after a casino town in southern France. Never heard of that? John von Neumann and Stanislaw Ulam invented the model during the 2nd world war for improved decision-making in any uncertain situation.

Often modeling a probability is not easy to predict due to random variables. When multiple variables influence different outcomes, Monte Carlo is preferable. It is an ideal process to have long-term predictions with accuracy.

Steps in the method of Monte Carlo

There are 3 steps in the Monte Carlo technique.

- The first action is setting up the predictive model. That includes identifying dependent and independent variables.

- Next comes specifying independent variables’ probability distribution. The user applies historical data or/and their subjective judgment to define the value range and assign probability weights.

- The last step is about repeatedly running the simulations. Here, random values are generated from independent variables.

The simulation process of Monte Carlo

Monte Carlo simulation doesn’t go parallel to other normal models. It is actually a random evolving process. Getting a result from it seems quite confusing for the first time but later makes good sense.

In the beginning, the model predicts a set of outputs based on an estimated value range vs. a fixed input value set. The probabilities and their changes appear as values at different points.

The system then recalculates the results by using random numbers again and again. To do this, it follows the range of maximum and minimum values.

The process runs for thousand times to get the expected/ideal number. The more input number is, the more accuracy is expected as the outcome.

Let’s try to relate the Monte Carlo simulation through an example.

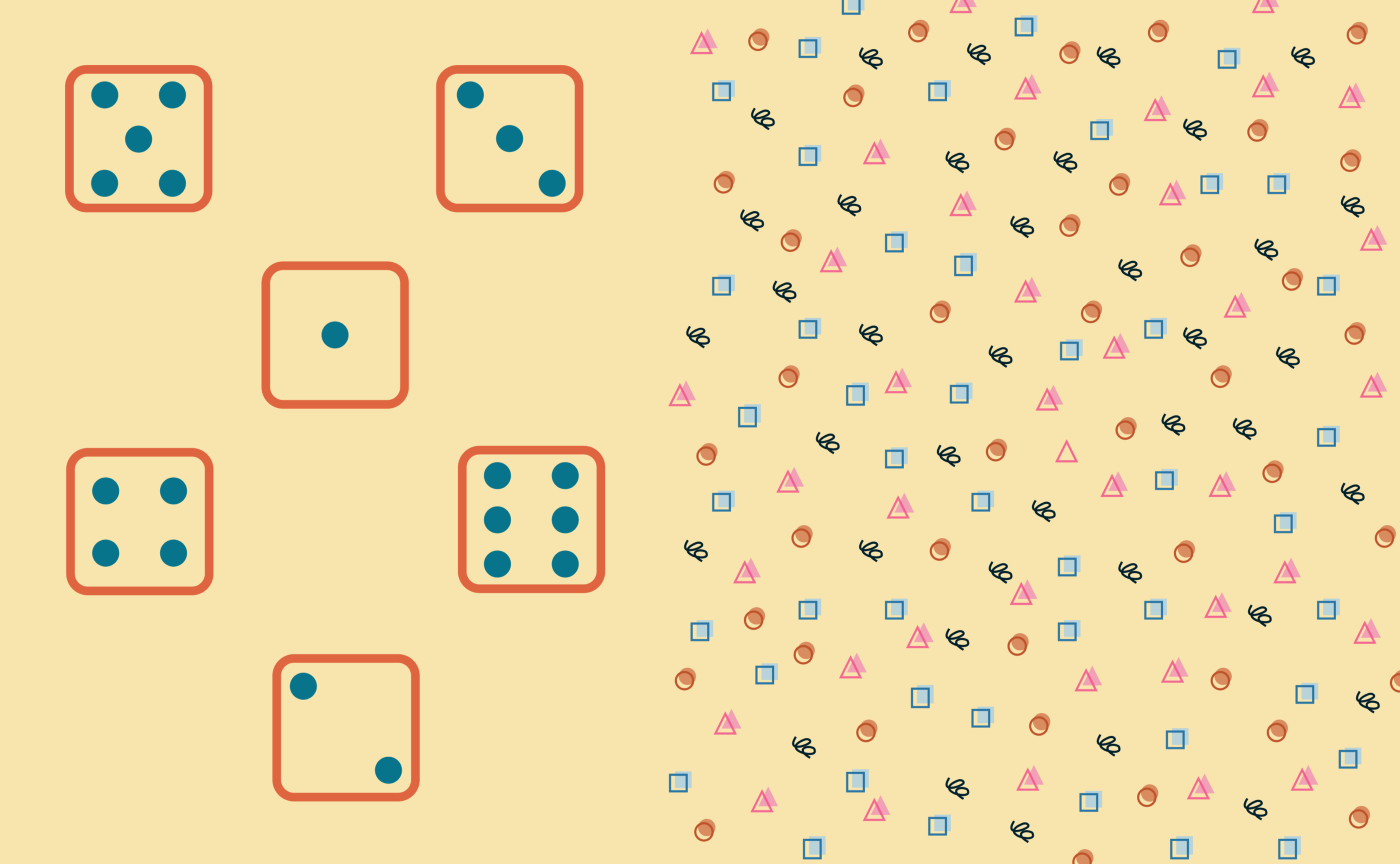

Suppose there are two dices, and we will calculate the probability of their rolling scores. Usually, the number of combinations is 36. A person can do the computation manually to get the probability of an outcome.

In Monte Carlo simulation, 10,000 times or more simulations of rolling take place. Thus, it provides more accuracy in predictions.

Monte Carlo simulation in IBM

In the advanced statistical software programs, the Monte Carlo simulation runs best. One of them is IBM SPSS Statistics which is risk analysis optimized. Its robust features help the system chalk out high-efficient results from the available data.

For example, it is possible to simulate different advertising budget amounts and see the effects on their total sales. The cloud function of IBM can be a good assist for the Monte Carlo simulation. It is possible to complete an entire Monte Carlo simulation in 90 seconds, and the number of concurrent invocations is 10,000.

There are also many other platforms like Excel and Palisade to run Monte Carlo simulations. Just the user has to follow different formulas and methods.

Things to remember

While working with Monte Carlo simulations, several points need to be considered.

- The simulation may provide the same result continuously. Thus, some correction or refining may need.

- Have an idea about pseudo-random numbers and ‘low-discrepancy’ sequence.

- Don’t stop the moment you have got an expected result.

- The simulation runs well if it is maintained with parameters, database, and other settings when it’s time.

Last Words

Decision-making is one of the major actions a company pursues. For that, risk analysis plays a vital role separately. Monte Carlo simulation gives you an easy and dependable outcome that you can depend on.

You now know how strong the performance of this method is after encountering a massive number of calculations repeatedly. It’s high time you knew more of it and learned to run it if you want correctness.