Table of Contents

Introduction:

It helps in the delivery of storage, database, software, analytics, networking, and intelligence over the internet or “cloud” for backup storage. It also facilitates Cloud Computing in Modern Business and Finance. It is both pay-as-you-go and free, depending on the purpose of this service.

Cloud Computing in Modern Business and Finance:

1.Enhancing Operational Efficiency:

Access to a wide range of cloud-based software applications and services streamlines operations. Automation of repetitive tasks improves productivity and reduces manual effort. Collaboration tools enable real-time communication and seamless teamwork.

2. Cost Savings and Scalability:

Elimination of on-premises infrastructure reduces upfront costs. The pay-as-you-go model allows businesses to scale resources based on demand. Efficient resource allocation leads to cost optimization and better financial management.

3. Improved Collaboration and Communication:

Cloud-based collaboration tools and platforms facilitate seamless communication and collaboration among team members, regardless of their physical locations. This enhanced connectivity enables efficient financial collaboration, real-time decision-making, and streamlined financial processes.

4. Data Security and Compliance:

Cloud service providers prioritize data security and invest in robust security measures, including encryption, access controls, and regular security updates. This helps businesses protect sensitive financial information and ensure compliance with relevant regulations and industry standards.

5. Business Continuity and Disaster Recovery:

Cloud computing offers reliable data backup and disaster recovery solutions. By storing data in the cloud, businesses can quickly recover and resume operations in the event of a disruption, such as a natural disaster or hardware failure. This ensures continuity of financial operations and minimizes potential financial losses.

6. Advanced Data Analytics and Business Insights:

Cloud computing allows businesses to collect, store, and analyze large volumes of data. Cloud-based analytics platforms provide valuable insights into financial performance and customer behavior. Informed decision-making based on data-driven insights leads to better financial strategies and outcomes.

7. Remote Work Enablement:

Cloud computing has become even more crucial in the era of remote work. Cloud-based applications and services allow employees to access financial information and perform their tasks from anywhere, fostering productivity and collaboration regardless of geographical constraints.

8. Cost-effective Disaster Recovery:

Cloud computing offers cost-effective and reliable disaster recovery solutions. Instead of investing in separate backup systems and infrastructure, businesses can leverage cloud-based backup and recovery services, ensuring data redundancy and minimizing downtime in case of system failures or disasters.

9. Collaboration with External Stakeholders:

Cloud computing facilitates collaboration with external stakeholders such as clients, vendors, and partners. Businesses can securely share financial information, documents, and reports with relevant parties, enabling smoother communication and collaboration in financial transactions and decision-making processes.

10. Accessibility and Mobility:

Cloud computing enables businesses to access their financial data and applications from anywhere with an internet connection. This accessibility promotes mobility and allows employees to work remotely or collaborate with colleagues and clients across different locations, enhancing productivity and efficiency.

11. Integration with Third-Party Applications:

Cloud computing platforms often provide seamless integration with third-party applications, allowing businesses to connect their financial systems with other essential tools. This integration streamlines workflows, automates processes, and enables data exchange between different applications, improving overall operational efficiency.

Advantages in Cloud Computing:

1. Cost savings and scalability: Cloud computing reduces infrastructure costs and provides scalable resources to meet changing business needs.

2. Accessibility and mobility: Cloud-based systems enable remote access to financial data and support flexible work arrangements.

3. Data security and reliability: Cloud services offer robust security measures and reliable backup systems to protect financial information.

4. Collaboration and communication: Cloud-based platforms facilitate real-time collaboration and effective communication among team members.

5. Business continuity and disaster recovery: Cloud computing ensures quick recovery and minimizes downtime in case of system failures or disasters.

6. Advanced analytics for decision-making: Cloud-based analytics tools provide valuable insights for data-driven financial decision-making.

7. Application integration and flexibility: Cloud solutions seamlessly integrate with other applications, enhancing operational efficiency and flexibility.

8. Access to innovation and competitive advantage: Cloud services provide access to cutting-edge technologies, fostering innovation and enabling businesses to stay competitive.

Disadvantages Of Cloud Computing:

1. Dependence on Internet Connectivity: Cloud computing heavily relies on internet connectivity. If the internet connection is unreliable or experiences downtime, it can disrupt access to cloud-based financial systems and data, impacting business operations.

2. Data Security and Privacy Concerns: Storing financial data on cloud servers raises concerns about data security and privacy. Although cloud service providers implement robust security measures, businesses must carefully evaluate the security protocols and data handling practices of their chosen provider.

3. Limited Control and Customization: With cloud computing, businesses have limited control over the infrastructure and software. Customization options may be restricted, which can pose challenges for businesses with unique financial processes or specific compliance requirements.

4. Potential for Vendor Lock-In: Once a business migrates its financial operations to a particular cloud provider, transitioning to a different provider can be complex and costly. This vendor lock-in situation can limit flexibility and hinder the ability to switch to better-suited solutions in the future.

5. Downtime and Service Disruptions: Although cloud service providers strive for high availability, there is still a possibility of downtime or service disruptions. These interruptions can impact financial operations, causing delays, and potentially resulting in financial losses.

6. Compliance and Legal Considerations: Businesses operating in regulated industries, such as finance, must ensure that their cloud computing solutions comply with industry-specific regulations and legal requirements. The responsibility lies with the business to verify that the chosen cloud provider meets these compliance standards.

7. Data Transfer and Bandwidth Limitations: Transferring large volumes of financial data to and from the cloud can be time-consuming and may incur additional costs if bandwidth limitations are exceeded. This can affect the speed and efficiency of data transfer and impact business productivity.

8. Long-Term Cost Considerations: While cloud computing can offer cost savings in the short term, long-term costs can accumulate as usage and storage needs grow. Businesses should carefully assess pricing models and consider the total cost of ownership over time.

9. Limited Offline Access: Cloud-based systems typically require an internet connection to access data and applications. In situations where internet connectivity is unavailable or unreliable, accessing financial information and performing critical tasks can be challenging.

10. Reliance on Service Provider: Businesses relying on cloud computing are dependent on the performance and reliability of their chosen cloud service provider. Any issues with the provider’s infrastructure, service outages, or changes in service offerings can impact business operations.

FAQs about Cloud Computing in Modern Business and Finance:

How does cloud computing benefit businesses in finance?

Cloud computing offers several benefits for businesses in finance, including cost savings, scalability, accessibility, data security, collaboration, business continuity, advanced analytics, application integration, and access to innovation.

Is cloud computing secure for financial data?

Cloud service providers implement robust security measures to protect financial data. However, businesses must carefully assess the security protocols and data handling practices of their chosen provider to ensure compliance with data security and privacy regulations.

Can cloud computing support compliance requirements in the finance industry?

Cloud computing can support compliance requirements in the finance industry. However, businesses must ensure that their chosen cloud provider offers compliance certifications and follows industry-specific regulations, such as data protection and privacy laws.

What happens if the internet connection goes down? Will I lose access to my financial data?

If the internet connection goes down, access to cloud-based financial systems may be temporarily disrupted. However, many cloud services offer offline capabilities or have backup measures in place to ensure continuity of operations during such situations.

How can cloud computing improve collaboration among finance teams?

Cloud-based collaboration tools allow finance teams to work together in real-time, share financial documents, and communicate effectively. This fosters collaboration, enhances teamwork, and streamlines financial processes.

Can I customize cloud-based financial systems to suit my business’s specific needs?

Customization options for cloud-based financial systems may vary depending on the service provider. While some level of customization is usually possible, businesses should carefully assess the flexibility and customization capabilities offered by their chosen provider.

How cloud computing supports the modern day business?

The core business model of cloud computing is to provide flexibility in the workplace. It also facilitates managing complex IT infrastructure. The key focus of cloud computing is to work with a cloud partner in improving the business.

How is cloud computing used in finance?

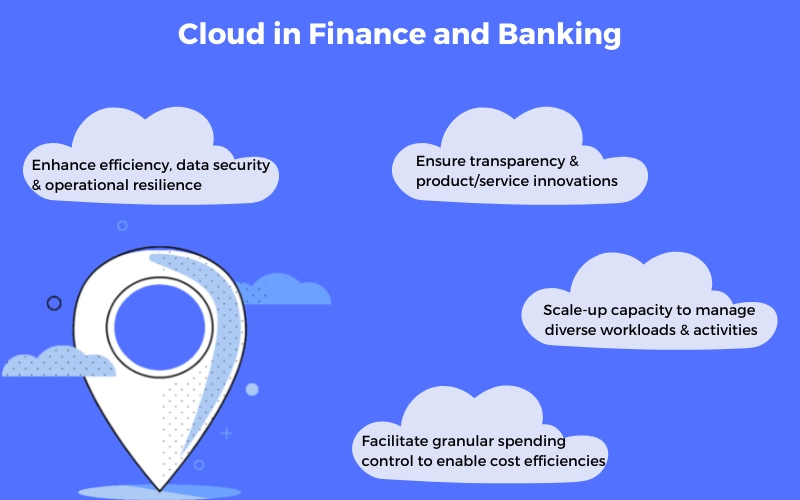

Cloud Computing in financial services is a kind of on-demand service that offers online access to pooled resources, programs, or storage. It makes it possible for financial organizations to process and store data on remote servers rather than on their local systems.

How is cloud computing affecting the way companies do business?

Like most software, business software goes through upgrade cycles for security patches, new features, and the occasional bug fix. Cloud computing places the responsibility of upgrades on the cloud software vendor, which can help make technical support more efficient.

Conclusion:

In conclusion, Cloud Computing in Modern Business and Finance by providing flexibility, cost savings, improved collaboration, data security, disaster recovery capabilities, advanced analytics, and remote work enablement. By embracing cloud technologies, organizations can enhance their financial operations, streamline processes, and drive business growth in today’s digital landscape.