When you examine the food delivery industry as it exists today, you will realize that one brand has stood out and has done a good job of revolutionizing the way we think and experience dining. Here we are talking about DoorDash Edged Out Impressive Q1 Sales Revenue with Cost Concerns Tempering Investor’s Sentiment.

The company’s performance during the first quarter of 2024 has drawn the attention of investors and industry experts. It reveals that it has achieved tremendous success while also struggling with some major issues.

We are discussing DoorDash Edged Out Impressive Q1 Sales Revenue with Cost Concerns Tempering Investor’s Sentiment:

Table of Contents

Surpassing Expectations of DoorDash

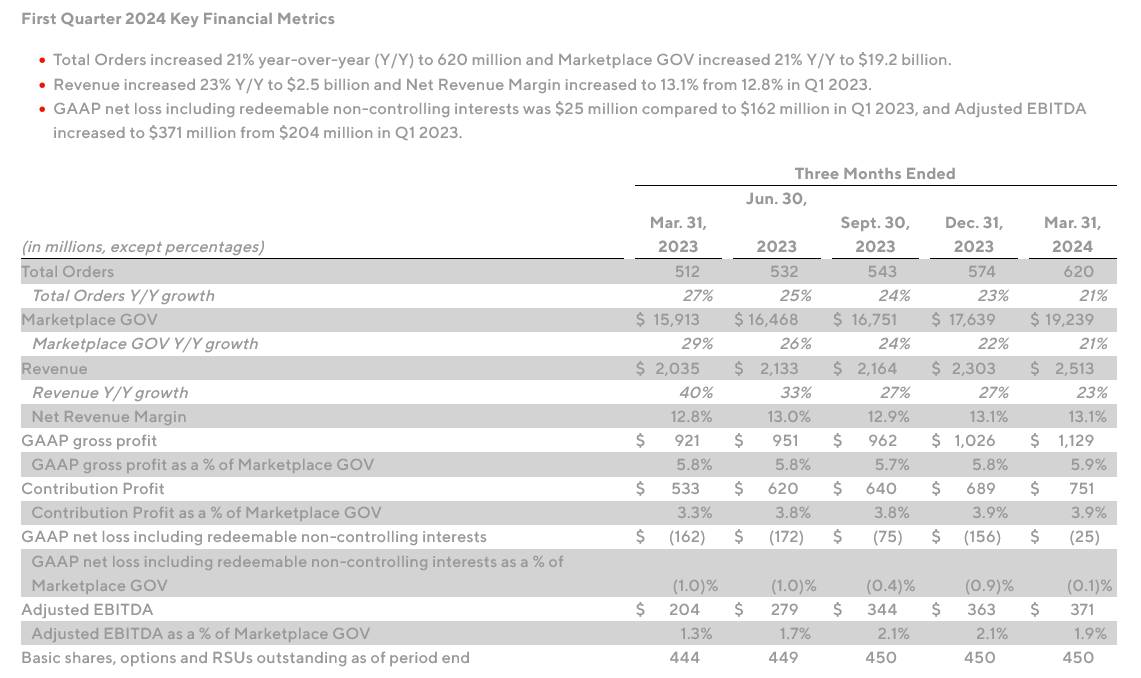

DoorDash forked the market predictions by reporting a huge 222% year-over-year gain, taking the quarter one revenue to a record $2.51 billion. This exceptional figure exceeded forecasts of $2.45 billion on Wall Street, confirming DoorDash as a leader in the dynamic and fiercely competitive food delivery sector.

DoorDash’s Main Factor Behind the Growth

Grocery Delivery Boom

One of the major reasons for the prosperity of the online takeout food company DoorDash has been the exponentially growing segment of grocery delivery. What fueled the sales for U.S. grocery orders on the platform in this period was the fact that consumers more readily accepted the comfort of having home essentials delivered to their doorsteps as compared to the previous year.

In a strategic attempt to exploit this emerging phenomenon, DoorDash has proactively grown its Grocery partnership program. Notable collaborations include:

- Giant Eagle engaged its stores in multiple states in the same-day DoorDash delivery following its online expansion in March.

- Haggen and Vallarta Supermarkets, both grocery stores located on the West Coast, were added to the Instacart platform in April.

Resilient Restaurant Business

The growth of the grocery delivery segment has seen incredible feats, but the core restaurant business remains an indispensable component of DoorDash operations. The increase in the average order value of U.S. restaurants experienced a gradual but somewhat lighter pace compared to the year before.

One point to notice is that DoorDash users showing record order volumes indicate that the company’s restaurant delivery services are still attractive and convenient to consumers. Nevertheless, it admitted that its ventures established recently with the help of grocery delivery are moving the company’s growth pace faster than its existing restaurant segment.

Concerns of Investors and Cost Aspects

Despite the promising revenue levels, DoorDash’s stock prices saw a sharp decline of more than 15% in extended trading on Wednesday evening. Such decline can be ascertained by the fears investors may hold regarding the company’s rising expenses and possible profitability failure.

Narrowing Losses, but Higher Expenses

Although DoorDash has succeeded in bringing its Net Income down to $23 million in this quarter, it was a huge loss of $161 million in the same quarter in the preceding year. Meanwhile, the company’s costs are rising. The class that stands out is DoorDash’s marketing and research expenses, which went up in the recent quarter.

In addition, after large-scale layoffs at the end of 2022, the company has now started hiring new team members to particularize the product development department. DoorDash’s Chief Financial Officer, Ravi Inukonda, described the company’s long-term strategy as being towards providing good growth, not just for this year but for the coming few years.

Regulatory Challenges and Financial Burdens

Another reason investors consider their decisions is the introduction of rules in places like New York and Seattle, where there are minimum wage laws for delivery people. Based on its projections, the impact of these regulations will translate to a total loss sales figure of $110 million in New York and $40 million in Seattle for DoorDash’s merchants combined.

Although the firm incurred some of these decreased costs during the 1st quarter, it anticipates a decreasing trend for these costs in the coming quarters. Nevertheless, this norm may dampen DoorDash’s financial performance.

Earnings Expectations and Profits Prospects

Last quarter, DoorDash’s estimated pre-tax profit of between $325 million and $425 million didn’t meet the analysts’ projection. Midway through the presented range, we get $375 million, which is lower than the $394 million predicted by the industry experts.

Inukonda believes the company will be able to improve its pretax earnings by the second half of 2024. Meanwhile, investors stay vigilant and keenly watch how well DoorDash handles cost efficiency and regulatory challenges to continue its immaculate track record of fast growth.

Overcoming Headwinds and Taking Advantages of Opportunities

Despite the difficulties it faces, including increases in costs and regulations, DoorDash still sees bright possibilities for its future. The company’s chief executive officer, Tony Xu, recognized some problems, including a lack of foot traffic in shops, but focused on the digital demand in food delivery.

Coping with the Changing Consumer Behavior

Since inflation-conscious consumers around the U.S. and other markets are gradually shifting from dining out to consuming at home, DoorDash, the online food delivery platform, has devised new strategies to cater to this ever-changing trend. The company’s stellar performance in the grocery delivery segment is firm evidence of its agility, which allows it to keep up with changing consumer tastes and grab new market opportunities.

Regulatory Environment and the Outlook of the Future

While Xu acknowledged the effectiveness of measures implemented in cities like New York and Seattle, he asserted that such measures aren’t the likely candidates to sweep the nation or the entire planet. He stressed the immense economic benefits of the food delivery industry and the way that it contributes to consumers and gig staff at the same time.

FAQ’s

What are DoorDash’s key growth drivers in Q1?

Its key growth drivers in Q1 include market expansion, strategic partnerships, and digital initiatives aimed at enhancing the user experience.

How are rising costs impacting this company’s profitability?

Rising costs, including driver incentives and technology investments, are eroding the company’s profitability, raising concerns among investors about its long-term sustainability.

What are investors’ sentiments regarding DoorDash’s performance?

Investors remain cautiously optimistic about the company’s long-term growth prospects but are concerned about its ability to manage costs and sustain profitability amidst intense competition.

Conclusion

The stellar showings of DoorDash in the first quarter have translated to its being a player to reckon with in the food delivery business. Even though the company’s journey to sustained profitability is not free from difficulties, there are some ways to get around it. With the regulatory environment fluid and rising costs, DoorDash must keep innovating, changing consumer habits, and employing its efficiency in the restaurant and grocery delivery sectors.

Investors will be paying close attention to how the company is able to sufficiently resolve the issue of costs, seize opportunities and execute the aggressive growth strategy it has planned. At the end of the day, a strong performance for DoorDash will come from striking a delicate balance between staying true to its value-based model and staying competitive while delivering a quality customer experience in a rapidly changing environment.