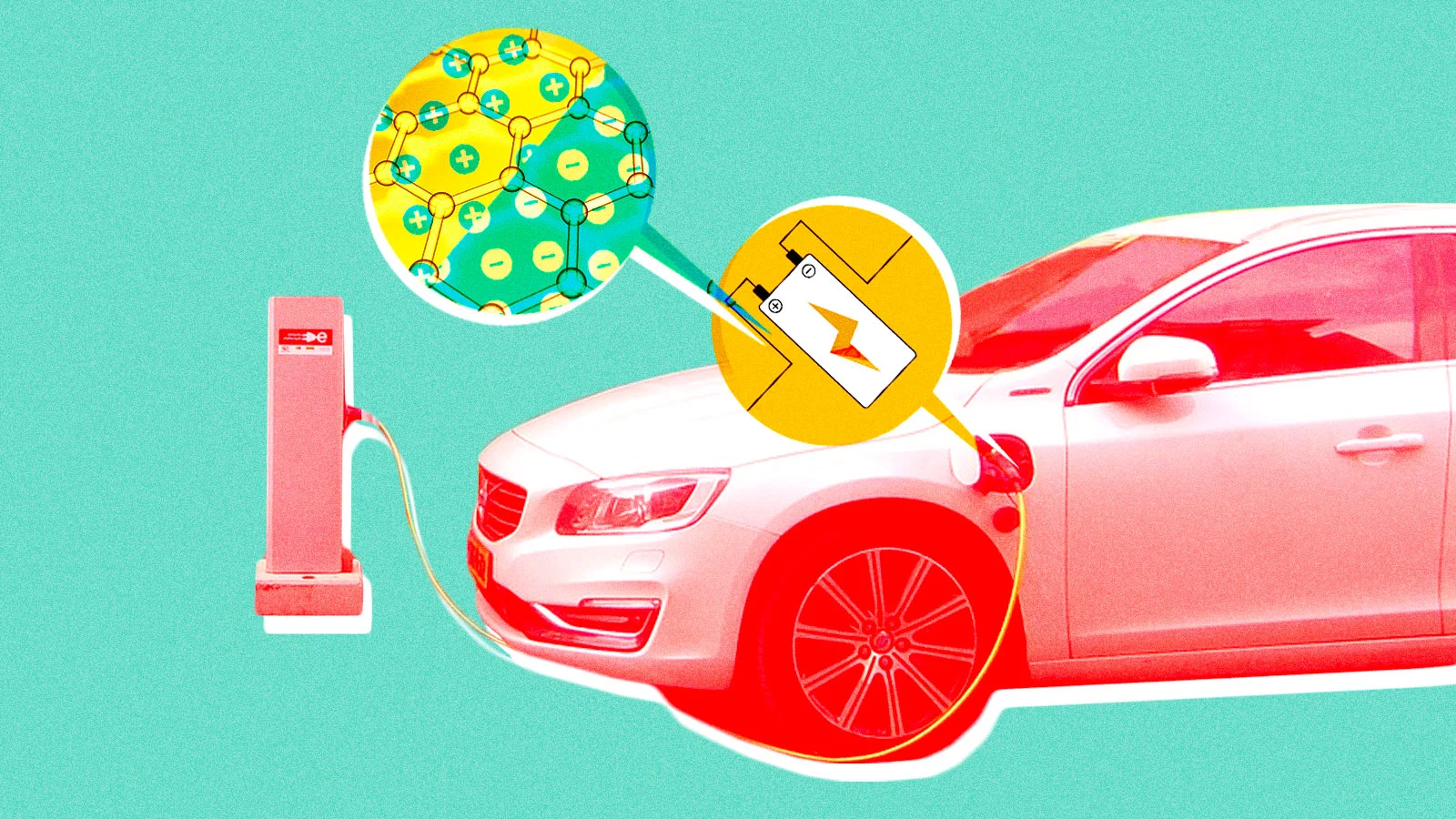

Carmakers have concentrated on range in the race to become electric to allay consumer concerns about the infrastructure for charging, but battery manufacturers are already developing the smaller, more durable, and less expensive batteries of the future, which also charge more rapidly.

While automakers compete with market leader Tesla Inc. to produce vehicles that can go at least 300 miles (482 km) between charges, battery startups anticipate that as public EV chargers proliferate, range will become less of an issue. Startup companies are experimenting with materials like silicon-carbon, tungsten, and niobium in their search for smaller batteries that charge very rapidly.

Since the battery is the most expensive component of an EV, true fast charging along with widely accessible chargers – a lack of which is currently thought to be slowing broader adoption of EVs – would enable automakers to build cars with smaller batteries at more affordable prices while boosting profit by selling more vehicles to a wider audience.

China produces the majority of the world’s EV batteries, but businesses like Contemporary Amperex Technology Co (CATL) are working to make batteries that can last longer between charges.

Chinese automakers have launched affordable, compact EVs like the Wuling Hongguang Mini, which is still available for about $6,500 despite recent increases in battery prices. SAIC Motor Corp Ltd, General Motors Co, and Wuling Motors collaborated to create the vehicle.

Western firms are developing electrode materials to commercialise ultra fast-charging batteries, including Cambridge-based Nyobolt and Echion Technologies and Woodinville, Washington-based Group14 Technologies.

PitchBook, a startup data platform, reports that as carmakers looked to the future, investments in EV battery technologies increased more than sixfold to $9.4 billion in 2021 from $1.5 billion in 2020.

Using less cobalt and nickel, where China dominates the refining and processing, by going tiny might further relieve impending battery material constraints as EV demand grows.

Another advantage is that automakers may tout sustainability victories by utilising less damaging materials in EVs and producing them with less CO2.

Others are improving battery efficiency, as demonstrated by Mercedes-EQXX Benz’s prototype with a 1,000 km range (621 miles).

The capacity of EV batteries to quickly absorb electricity currently limits fast charging. Fast charging can decrease battery life or cause them to overheat, thus most EVs include speed limits to safeguard the batteries.

CEO Shivareddy of Nyobolt charges four batteries in around three minutes at the company’s headquarters before plugging them into a robotic vacuum that is actively sweeping the floor behind him as he speaks.

The world’s greatest reserves of niobium, a stable metal frequently used to reinforce steel, are found in Brazil and Canada. Niobium can withstand extremely quick charging while lasting many years longer than current batteries, according to firms like Nyobolt and Echion when used in anodes or cathodes.

Shivareddy stated that it will take years of validation before carmakers are ready to employ Nyobolt’s batteries in mass-market cars. Nyobolt is concentrating on high-performance racing EVs.

Startups are also looking at other materials besides niobium.

The silicon-carbon anode material produced by Group14 Technologies allows lithium-ion batteries to store up to 50% more energy. In May, the business raised $400 million from investors.

Battery manufacturer StoreDot, supported by Mercedes, tested Group14’s materials and charged batteries to 80% of their capacity in 10 minutes. Rick Luebbe, CEO of Group14, said that the anode material could provide a quick EV charge in five minutes.