MobiKwik, an Indian financial services firm, has set its sights on raising approximately $84.2 million by issuing fresh shares in an initial public offering within India, per a draft prospectus submitted to the local market regulator on Friday.

(Image Source: Techcrunch.com)

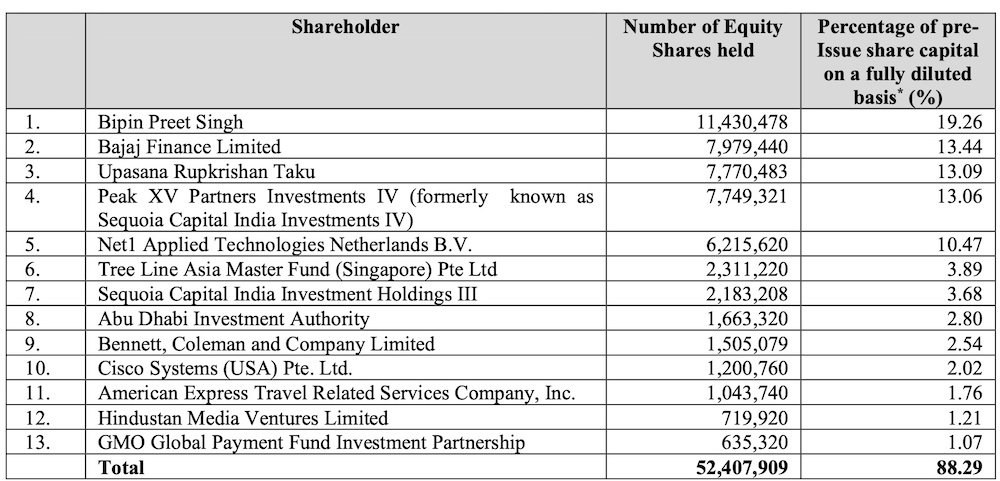

This marks MobiKwik’s second endeavor at an IPO. Despite its earlier plan to raise around $250 million in 2021 by offering new and existing shares, the company, backed by Peak XV, the Abu Dhabi Investment Authority, and American Express, had to shelve these ambitions due to challenging market conditions.

As per the revised prospectus, the company, established 15 years ago by Bipin Singh and Upasana Taku, a couple who are co-founders, plans to sell only some existing shares during the IPO. Instead, it aims to secure approximately $16 million via a pre-IPO arrangement.

MobiKwik operates an extensive online marketplace offering diverse financial services, from credit options to digital payments to investment prospects and insurance products. The company has grown substantially, amassing a user base exceeding 146 million and collaborating with 3.8 million merchants. Initially focusing on mobile wallet services, MobiKwik has significantly broadened its scope to include wealth management, insurance distribution, personal loans, merchant cash advances, “buy-now-pay-later” credit, and more.

In the fiscal year 2023, MobiKwik’s Zip buy-now-pay-later service facilitated loan disbursements totaling $490 million, marking a remarkable 21-fold surge compared to the preceding two years. The overall transaction value, covering both credit and payment products, soared significantly, quadrupling from $1.78 billion in fiscal year 2021 to $3.15 billion in fiscal year 2023. MobiKwik aims to leverage its extensive user base and merchant network to cross-promote various financial products, seeking further capitalization.

As detailed in the prospectus, SBI Capital and DAM Capital are designated as the primary book-running managers for the IPO. Following losses in fiscal years 2021, 2022, and 2023, MobiKwik achieved profitability in the six months concluding on September 30, 2023. The company reported $29.3 million in revenue during this period, with a $1.1 million profit.

MobiKwik joins the ranks of Indian firms preparing to go public this year. Loss-making enterprises like Ola Electric and FirstCry recently filed draft prospectuses for their initial public offerings.

In essence, MobiKwik’s $84 million IPO pursuit in India underscores its bold growth objectives and financial ambitions. This strategic move symbolizes a significant stride for the company, aiming to amass substantial funds for expansion and solidification within India’s financial technology realm. MobiKwik’s venture into the IPO sphere underlines confidence in its business model, reflecting the broader trend of digital payment platforms seeking increased investor backing and expanding their presence in India’s thriving fintech sector.

(Information Source: Techcrunch.com)