After the streaming behemoth disclosed that it lost subscribers in the first quarter, Netflix Inc. shares plunged 35.1 percent on Wednesday, marking the company’s worst day since 2004.

The billionaire investor William Ackman, whose fund purchased more than three million shares of Netflix in January, announced on Wednesday that the firm had liquidated its holding at a loss. Mr. Ackman stated in a letter to investors that Netflix will cut Pershing Square’s returns by four percentage points. This translates to a $400 million loss.

Mr. Ackman claimed in January that Netflix had a “excellent price,” but he wrote on Wednesday, “We have lost confidence in our ability to foresee the company’s future prospects.”

The stock dropped $122.42 to $226.19, losing more than a third of its value. The stock had the worst day in the S&P 500. The firm was projected to attract new users in the quarter, according to investors. Instead, Netflix announced that it had 200,000 fewer customers in the first three months of the year than it had in the fourth quarter, and that it expects to lose two million global users in the current quarter.

A number of other streaming stocks dropped on Wednesday. Warner Bros. Discovery Inc. was down $1.48, or 6%, to $23.01. Paramount Global was down $3.12, or 8.6 percent, to $33.16, and Warner Bros. Discovery Inc. was down $1.48, or 6%, to $33.16. The Walt Disney Company fell $7.33 (5.6%) to $124.57, while Spotify Technology SA fell $14.92 (11%) to $122.49.

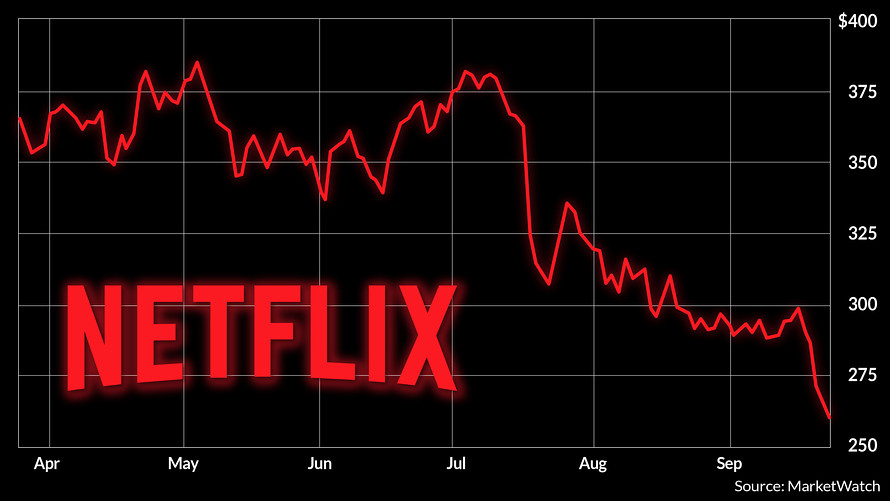

Netflix’s stock dropped the most in a single day since Oct. 15, 2004, when it dropped 41% after announcing that it would slash membership costs and postpone planned overseas growth. It wiped $54.3 billion off the company’s market valuation in one day, the greatest one-day market capitalization loss ever.

The stock has dropped for the second time this year. When Netflix said in January that it anticipated to attract a considerably fewer number of customers than the previous year, the stock dropped more than 20%. This year, the stock has lost 62 percent of its value, including Wednesday’s drop.

In the early months of the coronavirus epidemic, users flocked to Netflix as lockdowns and steps to contain the virus kept people at home, bringing the company’s stock price to new highs. Over the last year, Netflix’s development has been hampered by the relaxation of regulations and increased competition from rival streaming providers.

“No one expected Netflix to see a drop in subscribers. They expected a drop in subscriptions, but losing subscribers is a major concern,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, an online broker.

Consumers have become increasingly price-sensitive as the number of streaming alternatives has grown. Netflix is one of the only big streaming providers that has yet to consider an ad-supported, cheaper version. Hulu, owned by Disney, has done so for a long time, while HBO Max and Disney+, both owned by Warner Bros. Discovery, have also moved into ad-supported streaming.

Investors are concerned that higher costs will reduce consumer spending on non-essential products and services.