WhatsApp has obtained approval from The National Payments Corporation of India (NPCI) to further open up its payment service to a whopping 100 million users across the south asian market.

This follows WhatsApp’s previous rollout of its payment solution to 40 million users. WhatsApp reaches over 400 million users in India making it its largest market by number of users.

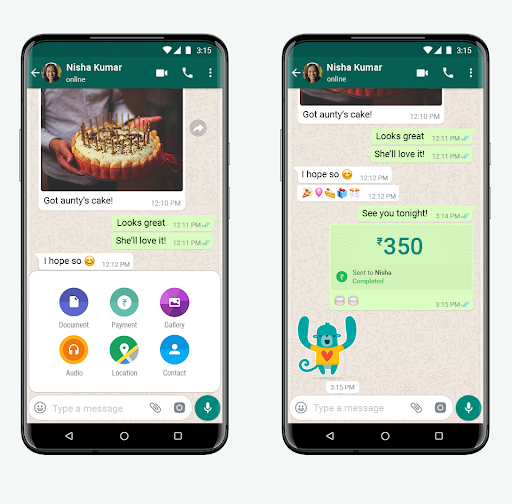

The WhatsApp payment service enables users to exchange money with one another and also to settle business transactions. Usually there are no fees for users for sending or receiving money but businesses accepting payments will be subject to a processing fee. WhatsApp is a great example of a mobile app development that provides a solution to an everyday problem effectively and profitably.

According to official NPCI figures PhonePe (backed by Walmart) and Google Pay lay claim to over 70% of the UPI market share and the slow roll out of WhatsApp payment solutions has enabled its competitors to obtain an advantage. PhonePe recently mentioned that it processed 100 million transactions in a single day, using UPI technology.

Demonetisation

The popularity of UPI technology skyrocketed back in 2016 when the incumbent government decided to invalidate almost 85% of its paper cash in circulation overnight.

As of midnight on the 8th of November, 2016 the incumbent Government of India announced the demonetisation of all INR 500 and 1,000 banknotes, belonging to the Gandhi series of issue.

The government also indicated that it would issue new INR 500 and 2,000 banknotes in exchange for the demonetised banknotes. There were many reasons for this exercise. Firstly according to the Prime Minister this action would limit the shadow economy of India and secondly it would serve to increase cashless transactions and in doing so furthermore reduce counterfeit cash that was funding terrosrism and other illegal activities.

The following weeks were totally chaotic as millions had to stand in lengthy queues to exchange their old banknotes for new ones. Many deaths were also recorded from those standing in line.

The entire process of demonetisation was later reviewed to have been unfair and actually not serving the purpose as according to the Reserve Bank of India, approximately 99.3% of the demonetised banknotes had been deposited with the banking system.

There were several protests and strikes surrounding this action by the government that failed to reveal much of the black money that was in circulation.

Lost in a Maze

WhatsApp piloted its payment services in 2017 but a maze of bureaucracy ensured it was a slow start. This was especially relevant in terms of the discussions and conversations that were taking place about the impact of giving WhatsApp owner Meta, too much power.

WhatsApp may have something going for it as the NPCI is actively looking at enforcing a rule that no single payment services app can process more than 30% of all UPI transactions in any given month. Tata Digital and Bengaluru based Slice are also set to benefit from the NPCI ruling.

It is however important to note that when using platforms such as WhatsApp payment services the level of safety and security is very high. As the messages on the system are secure the chances of fraud taking place is very minimal. Mobile app Developers Elegant Media are specialists in building, developing and deploying safe and secure mobile applications for a variety of payment services.

WhatsApp payments was also launched in June 2020 in Brazil (the second largest market for WhatsApp) but was quickly ordered by the Central Bank of Brazil to suspend its operations, as bank regulators wanted to preserve the existing competitive payments market in Brazil.

WhatsApp payments have the power to empower a new generation of entrepreneurs and bring the advantages of cashless transactions to a glowing globalized world.