Table of Contents

Introduction:

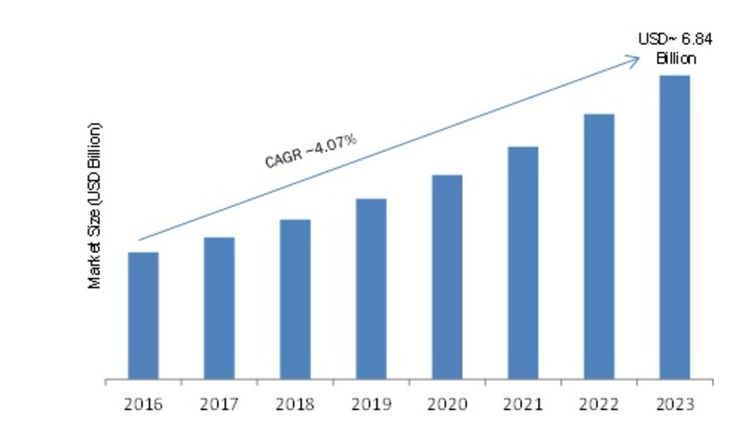

A study by Research Beam projects that from 2016 to 2020, the global data centre market will expand at an average rate of 10.7 per cent. The drive for improved operational efficiency while moving toward virtualization and automation among enterprises is credited with driving the industry’s growth. Global Switch, a company established in London, is a Billion Dollar Unicorn player in the data centre sector.

About Global Switch:

In Europe and Asia-Pacific, Global Switch is a prominent owner, operator, and developer of large-scale network-dense, carrier-neutral, multi-customer data centres. Our data centres offer our customers the dependability, security, and flexibility they need to host their IT infrastructure while also offering diverse ecosystems.

The ratings’ confirmation indicates a strong business profile for Global Switch, which is backed by its regionally diverse portfolio, healthy tenant base, and rising occupancy. The increase in internet traffic, mobile use, and cloud computing all contribute to the demand for data centre capacity. High asset and tenant concentration, as well as the less established demand for data centres, compared to other commercial real estate assets, reduce these advantages.

Leverage has been restored to a level consistent with the rating because the company has successfully re-contracted space formerly occupied by recently defaulting companies (Daily-Tech and SunGard). Major Rating Elements An excellent asset portfolio Global Switch owns and manages 13 data centres with a combined gross floor area of 460,000 square metres (sq m), a utility power supply capacity of 543 mega volt amps (MVA), and an estimated value of GBP6.2 billion.

The centres, which serve businesses ranging from managed service providers to IT, communication, and financial service providers, are situated in eight well-known locations around Europe and Asia-Pacific. They are network dense and multi-customer. Despite being concentrated, the market is varied, with the top 10 renters accounting for half of all gross rental income.

You can build direct connections to a wide range of service providers at Global Switch, allowing you the freedom to diversify your networks. In each of our data centres, customers have direct access to the largest Internet Exchanges, carriers, cloud providers, and ISP networks.

Global Switch, with a 7.7% market share of the global market, is the second-largest wholesale data centre co-location provider, according to Structure Research. San Francisco-based Digital Realty Trust, which holds a 20.5 per cent share of the market, is the market leader.

Through sustained growth, Global Switch hopes to close the gap between the players. There are presently six new data centres planned for release. It has formed a joint venture with Daily-Tech Beijing Co., Ltd to build a new data centre in Shanghai in an effort to close the gap with Digital Realty Trust. The company is expanding its presence in China.

Global Switch Founder & Team:

The 1998-founded Global Switch, which is run by Chief Executive Officer John Corcoran, owns, operates, and constructs data centres in Europe and the Asia-Pacific region. London, England, in the United Kingdom, is where Global Switch is based.

Global Switch History:

Since 2014, Global Switch has been run by CEO John Corcoran, who started the company in 1998. The firm’s original owners, billionaires David and Simon Reuben, sold nearly half of it to the Elegant Jubilee consortium, managed by Shagang, in 2016. Elegant Jubilee then acquired the majority of the company in 2018. In 2019, Shagang itself purchased 24% more. The business was given to Jiangsu Shagang, a division of Shagan with a Shenzhen headquarters, in November 2020.

According to Bloomberg, who learned about the possible sale from “unknown sources,” this is another instance of Chinese companies offloading freshly acquired assets. HNA Group, for instance, recently sold electronics reseller Ingram Micro.

Due to worries over security, some Chinese-owned businesses have started losing clients. For instance, in Australia, all governmental organisations had to vacate the Global Switch complex in Sydney by September 2020. In November 2020, that data centre also experienced a fire-suppression system issue that forced at least one client down.

There is a healthy market if Shagang decides to sell. Data centre construction boom and record-breaking purchase activity continued in 2020 as a result of growing reliance on internet services. In December, Synergy Research Group projected that the data centre industry experienced mergers and acquisitions of approximately $31 billion in 2020, more than twice as much as in 2019. The largest single transaction was Digital Realty’s $8.4 billion purchase of Interxion, which was agreed upon in 2019 and completed in the first quarter of 2020.

Global Switch Name & Logo:

Global Switch Highlight:

| Company Name | Global Switch |

| Founders | John Corcoran |

| Started at | 1998 |

| Competitors | Nested , Lamudi , and Wunderflats |

| Website | https://www.globalswitch.com/ |

| Revenue | 251.4 million pounds for 2021 |

| Country | London |

| Customer care Email | Not Known |

| Customer care Contact details | Not Known |

| Company Valuation | Not Known |

| Industry | Data Centre Industry |

| Headquarters | London, England |

Global Switch Revenue:

Global Switch withholds financial information. When it concluded the year with revenues of £358.4 million (or about $445.5), it had last disclosed its revenue. However, based on its credit ratings, it may be fairly inferred that it is a financially responsible corporation.

Global Switch now has the highest credit rating of any data centre company in the world after Fitch improved its BBB credit rating to BBB+ in 2014. Soon after, Moody’s raised Global Switch’s long-term issuer rating to Baa2. For the corporation, Standard & Poor’s has kept its credit rating at BBB.

Prior to December 2016, David and Simon Reuben’s company Aldersgate Investments owned the majority of Global Switch. Aldersgate sold 49% of its stake to Elegant Jubilee, a group of Chinese investors from the private sector, in December.

Li Qiang, the creator of Daily-Tech, put together the group, which is headed by the Jiangsu Sha Steel Group. The company was valued at $6 billion when the interest was sold for a cash payment of £2.4 billion ($2.96 billion).

According to its website, Global Switch, which was established in 1998, owns and runs 13 data centres with a combined area of around 428,000 square metres in Europe and Asia Pacific. According to its annual report, it reported an Ebitda of 251.4 million pounds for 2021, a 5.8% rise over the prior year.

Global Switch Funding & Investors:

Global Switch has 4 investors including Shagang Group and AVIC Trust.

| Date | Funding Amount | Funding Round | Investor Details |

| Aug 27, 2019 | $2.19B | PE | Jiangsu Shagang Group |

| Jul 03, 2018 | $2.76B | PE | IDC |

| Jun 19, 2017 | $560M | Conventional Debt | – |

| Feb 22, 2017 | $529M | Conventional Debt | Barclays, Credit Suisse and 3 others |

| Oct 04, 2000 | $66M | Conventional Debt | Royal Bank of Scotland |

Global Switch Business Model:

- Leading Chinese businesses and institutional investors have decided to invest strategically in Global Switch by purchasing a 49 per cent ownership in the company for £2.4 billion in cash.

- The strategic vision, management, and financial and operational guidelines of Global Switch won’t alter.

- Aldersgate Investments Limited, the present shareholder and a Reuben Brothers company, will now jointly control the business along with the investment vehicle of the consortium.

- Through service agreements with Daily-Tech, a top Chinese data centre firm, China Telecom Global, the end client, inked significant revenue-generating pre-commitments for new expansions in Singapore and Hong Kong.

- Launch of a joint venture with Daily-Tech to build a new data centre in Shanghai.

Today, Global Switch is also announcing significant customer pre-commitments in Singapore and Hong Kong, which concretely demonstrate the advantages of the deal and the potential for future expansion.

Through direct service agreements with Daily-Tech, China Telecom Global will, following the completion of construction, become the end customer in Singapore and Hong Kong for these pre-commitments. These pre-pledges, which rank among the largest customer commitments in the worldwide data centre market, will help Global Switch diversify its assets and sources of income.

Services Offered thru Global Switch:

The foremost owner, operator, and developer of sizable, multi-tenanted carrier-neutral data centres is Global Switch. The business was established back in 1998 when the digital revolution was still in its infancy. Since that time, Global Switch has expanded and now owns and runs 10 data centres spread across Tier 1 cities in Europe and Asia-Pacific.

It offers numerous private and public entities close to 300,000 square metres of the technical area. These businesses can effectively interact across numerous telecom, Internet, and cloud service providers thanks to its data centres.

Customers have access to data centre capacity at Global Switch’s data centres, which are equipped to house computer servers, network equipment, and IT infrastructure. These facilities include redundancy, 24-hour power and cooling, high levels of connectivity, security, sophisticated infrastructure and environmental monitoring.

All of its data centres are run in accordance with the Tier III + standard, which calls for dual-powered hardware, several uplinks, and fault-tolerant hardware. Over 99.999 per cent uptime has been proven by Global Switch’s data centres thus far across the portfolio.

Global Switch Awards & Recognition:

There is n data on it.

Global Switch Competitors:

Alternatives and possible competitors to Global Switch may include Nested, Lamudi, and Wunderflats.

Global Switch Latest News:

- Owners of Global Switch are prepared to begin the sale process. Jiangsu Shagang, a Chinese steelmaker, is prepared to sell a data centre business.

- Five companies have been shortlisted by the Chinese owner of Global Switch, a data centre firm, to purchase the company for up to US$11 billion.

Global Switch Future Plans:

With the launch of the final stage, Global Switch Hong Kong becomes the largest multi-customer, carrier and cloud-neutral data centre. Global Switch plans to go much further. Corcoran says that, within the next three years, Global Switch hopes to start work on the development of centres

FAQs about Global Switch:

Who founded Global Switch?

The 1998-founded Global Switch, which is run by Chief Executive Officer John Corcoran, owns, operates, and constructs data centres in Europe and the Asia-Pacific region.

Who owns Global Switch Limited?

Global Switch Holdings Limited.

Who is the global switch?

In Europe and Asia-Pacific, Global Switch is a prominent owner, operator, and developer of large-scale network-dense, carrier-neutral, multi-customer data centres. Our data centres offer our customers the dependability, security, and flexibility they need to host their IT infrastructure while also offering diverse ecosystems.

What industry is the global switch?

Data Centre Industry.

Who is buying Global Switch?

Five companies have been shortlisted by the Chinese owner of Global Switch, a data centre firm, to purchase the company for up to US$11 billion. According to reports this week, including one from Bloomberg, the five finalists are EQT, Gaw Capital, KKR, PAG, and Stonepeak.

Is Global Switch for sale?

Global Switch has been flirting with a sale for over a year, talking to potential acquirers back in January 2021 for an $11 billion sale. By November, Blackstone, KKR, Brookfield Asset Management, DigitalBridge Group, Digital Realty, and Equinix had lined up as potential acquirers.

Is the global switch listed?

Anglo-Chinese data centre operator Global Switch shelved plans to list on a public stock exchange last week after a string of bad news made economic prospects look worse than at any time since the 2008 financial crash.

What is the company named Switch?

The switch is a technology infrastructure ecosystem corporation whose core business is the design, construction and operation of the most advanced data centres, which are the foundations of the most powerful technology ecosystems on the planet.

Is Global Switch Chinese owned?

Since Chinese investors took control of London-based data centre company Global Switch over a three-year period beginning in 2016, the Australian government has been on a migration journey, moving data and applications out of the company’s data centre in Ultimo, Sydney, and into facilities owned by other providers.

Is Switch a private company?

Data centre operator Switch Inc has agreed to be taken private by DigitalBridge Group in a deal worth $8.38bn. Under the terms of the deal, DigitalBridge will acquire all outstanding common shares of Switch for $34.25 per share in an all-cash transaction valued at approximately $11bn, including the assumption of debt.

Conclusion:

Data centres created by Global Switch are known for breaking new ground in terms of scale, reliability, and connectivity. A total of 300,000 sq m of top-notch technical space is offered by the company’s 10 data centres, which are centrally placed in Tier 1 cities around Europe and Asia-Pacific. Additional developments are currently underway.